About

Neluns

Neluns is a new financial

ecosystem which functions as an innovative technology and giving permission to

operate with cryptocurrency and fiat. The motto of the company is to provide a

favorable environment for the growth of cryptocurrency market.

The Neluns vision focuses

on building the new all in one financial ecosystem that will have the

functionality of a bank, an insurance company and currency exchange. All these

modules will be seamlessly integrated and will equally support transactions

with crypto or fiat money bringing users experience to the next level. Since

all the three modules belong to the Neluns team it will be possible to keep the

fees quite competitive as opposed to the classic set up where all entities

belong to different owners generating an overhead costs for the clients.

The main objective of the

Neluns Company is to aim the financial ecosystem. It aims to combine a Bank, a

cryptocurrency Exchange and an Insurance Company all in a single platform.

Neluns is providing an overall solution to the public for personal and

corporate goals.

The function of the

Neluns is carrying out payments, purchasing, selling of cryptocurrencies and

fund withdrawals from any ATM. It has its own mobile application which is

supported by both Android version and iOS version. Their uses will be that they

can make the banking and exchanges operations very easy and can be accessed

from any part of the world.

Official

registration of fintech projects

The Neluns team is

leading active work on the preparation of registering the project in England

and receiving all necessary regulatory licenses. One of the main factors to

choose England, is the active support towards startups displayed by the Bank of

England.

The central bank of the

country established its own Fintech Accelerator. On the base of this platform,

project creators can exchange their ideas and developments, discuss market

development tendencies, as well as new technologies.

The accelerator aids the

development of specific companies, which leads to the development of the

fintech-sector as a whole. While at the same time, active support of

Blockchain-startups is carried out, which according to the opinion of

Accelerator representatives, can positively impact the nation’s financial

system, and increase its stability.

According to Mark Carney,

Governor of the Bank of England, a banking system reform, taking into account

new innovative technologies will occur either way. At the same time, fintech is

capable of changing the nature of money and central banks in the future, and

this will be felt by all financial service users.

It's worth noting that

even in 2015, the Banking Supervision of England issued a license to conduct

banking services to a fully virtual bank , with which clients can work solely

through a mobile application. Presently, the bank does not have any branches,

and they only have a description of the project on their website.

As a result, we can ascertain that England is

one of the best jurisdictions for fintech projects.

An alternative to the jurisdiction of England

is the jurisdiction of the United States of America.

Active

development of online banking.

As we already know,

Neluns has a broad target audience, whose issues shall be solved by the

project. But, in order to achieve success, it's necessary to consider the

external factors. Currently, online banking is actively developing in most

countries, many of them even open incubators, to support fintech projects. All

of this creates favorable conditions for the launch of Neluns.

PSD2

The PSD2 (Payment

Services Directive) taking effect on the 13th of January, 2018, opened up banks

to new possibilities and allowed to build new business models. With an emphasis

placed on the active implementation of API’s, the creation of Bank-as-aPlatform

models provides fintech startups with huge advantages. Existing “classical” banks are less

flexible. An established corporate culture, desire to minimize risks and

traditional approaches to problem-solving significantly complicates and extends

the process of integrating new innovations.

Such a situation opens up

huge possibilities to startups to become central links of the economy of the

future

Neluns combines within

itself all of the best aspects of a «classical» bank and revolutionary and

innovative financial technology based on the Blockchain.

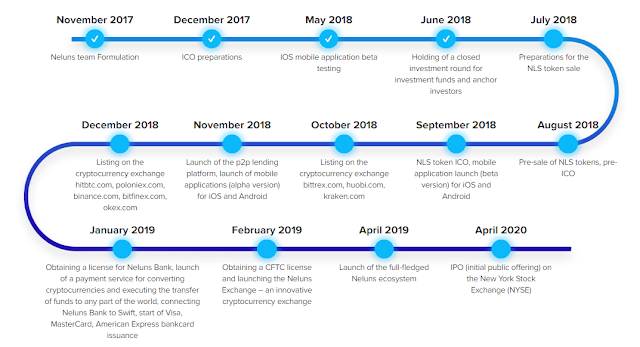

ROADMAP NELUNS

Results

Summarizing the aforementioned,

it can be concluded that Neluns has a broad target audience, which bump into

many serious problems. Existing solutions cannot solve their issues fully. A

comprehensive solution is necessary, because it's the only way to create a new

financial ecosystem, which will eliminate barriers on the path of development

of the cryptomarket and will make it possible to ubiquitously use

cryptocurrencies.

Aside from this, most

government body financial regulators actively support fintech startups. Online

banking is gaining traction, new and innovative solutions are emerging.

Traditional banks in such an environment are not always competitive.

All of this creates very

favorable conditions for the launch of the revolutionary Neluns project.

A comprehensive approach,

and the proposal of new, quality solutions, eliminating an array of target

audience issues, in combination with active fintech project support on a

government level line up Neluns for success.

Neluns

Ecosystem

To solve current

problems, limiting the possibilities of cryptocurrency market participants,

limiting the use of cryptocurrencies, and as a result, impeding the development

of the cryptoasset market as a whole, an innovative and comprehensive solution

is necessary.

Such will be the Neluns solutions – an

innovative financial ecosystem of the future.

The Neluns ecosystem

includes:

1.

Neluns Bank – A new generation bank,

presenting all key fiat banking services with cryptocurrencies.

2.

Neluns Exchange – An Innovative

cryptocurrency exchange, making secure and fast cryptocurrency trade operations

of any scale available.

3.

Neluns Insurance – Insurance company,

allowing to protect any transactions and trades executed by ecosystem

users.

Token

Information

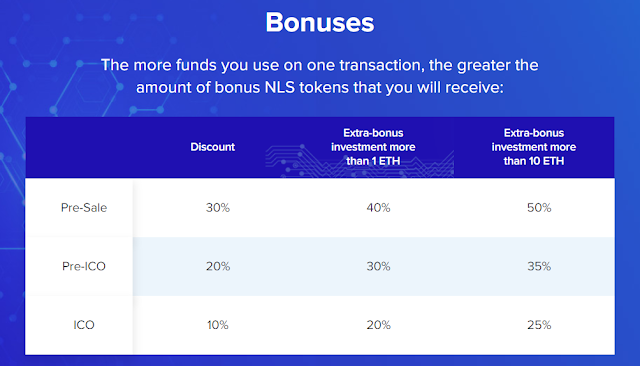

The tokens which are

created by the Neluns follows ERC20 standard used for security. They will be

providing the holders with approximately 50% dividends and it will be depending

on the Neluns ecosystem which includes Neluns Bank, Neluns Exchange, Neluns

Insurance profits. All the dividends will be reached out in quarters to the

holders in accordance with the number of tokens the user hold compared to the

total.

Token: NLS

Platform: Ethereum

Type: ERC20

Country: USA

Accepting: ETH

Price in ICO: 1 NLS = 1 USD

Soft Cap: 10,000,000 USD

Hard Cap: 112,000,000 USD

For

More Information :

Author

:

My

Address : 0x1F17b5de9D328F8c5b9Ba6250C02a0254F445f05

Tidak ada komentar:

Posting Komentar